Property Taxes are No Tea Party: 5 Questions to Ask Before Appealing Your Bill

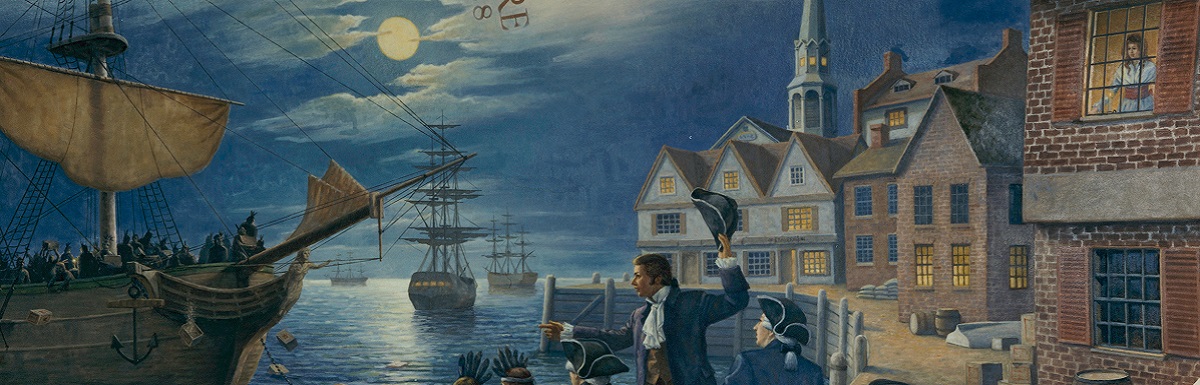

On December 16th, 1773, British colonists in Boston protested taxation without representation by dumping tea into the Boston Harbor. Was this the most efficient way to protest taxes? Probably not, though they did eventually achieve the desired result. When you get your property tax bill, you may feel like joining the Sons of Liberty in their rebellion.

Most of the time, your property tax bill is accurate, so destroying a shipment of tea will result in a vandalism charge or, at the very least, a lack of tea.

What can you do if you think your tax bill is too high? You may have options that don't include destroying property.

- Is my assessed value correct? Your assessed value, the number your tax bill is based on, is usually a percentage of the fair market value of your home. Does it seem too high? Call the county, or whoever sent the bill, and request a reassessment. Be prepared to document why your home should be valued at a lower amount.

- Is the property's use recorded correctly? If you just bought your house, and the previous owner was using it as an investment property, renting it to tenants, your bill will usually be lower if you're using it as your primary residence. Make sure the use is recorded accurately.

- How does my house compare to similar properties nearby? Comps are a great way to guess at how much your house is worth, and how it should be taxed. Websites like Zillow will show the price and tax history of nearby homes. How does yours compare?

- Did the report get the details right? Is your three bedroom home accidentally listed as a 13 bedroom home? Is your lot smaller than indicated? Typos happen. And they can affect your tax bill.

- Still think the bill is too high? Get ready to appeal. Contact the local government assessor that sent the bill and find out how to begin the process. There may be a filing fee, and you will need supporting documents to accompany your request.

Make sure you have a solid case before you decide to appeal the bill. Worst case scenario? You go through the process, filling out all the necessary paperwork, and your bill actually goes up. Before you proceed, talk to a professional (or three!) in your area. Your Realtor, if you used one to buy the property, is a good place to start. You can also consult with the appraiser you used when you bought the house, or your real estate attorney, who may or may not charge a fee for her time. You may also want to consult an attorney to find out if you qualify for any property tax exemptions due to your age, a disability, or your status as a veteran.

And if you end up right back where you started, just be thankful you don't have to pay property taxes to the British government!